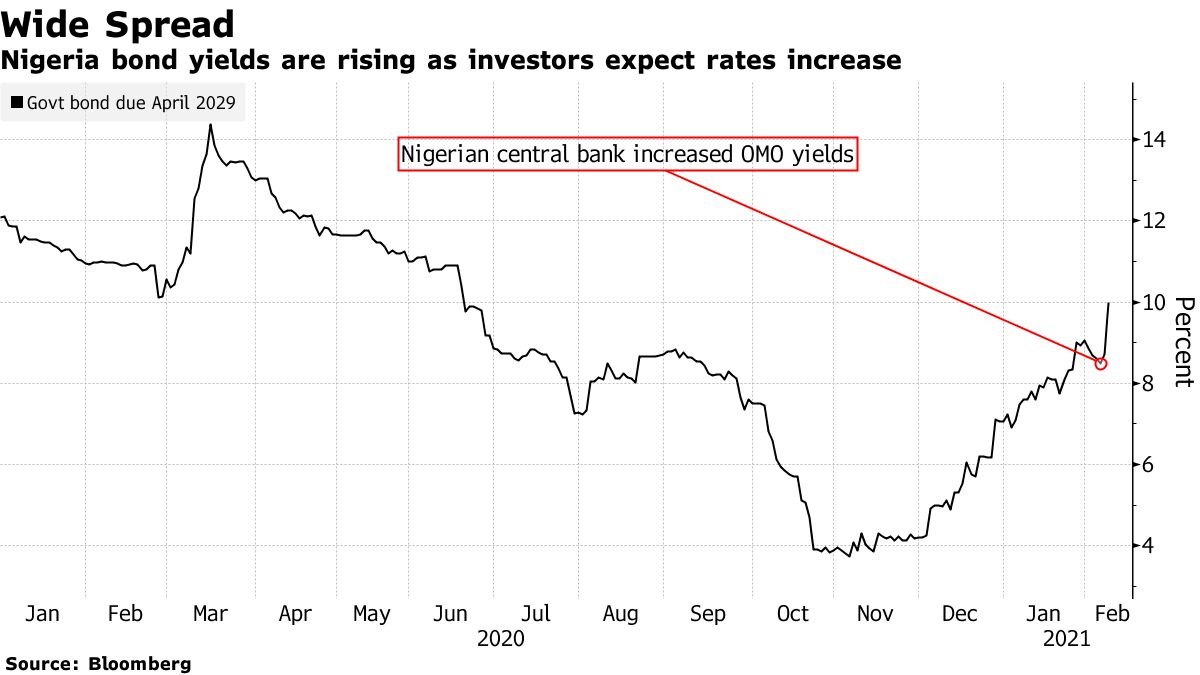

Investors are pruning their stock of Nigerian bonds in order to position themselves for higher yields

Nigerian bonds tumbled, pushing their yields as much as 164 basis points higher Tuesday, on forecasts for higher rates and inflation.

Debt across all maturities of central bank-issued Open Market Operations Bills, also known as OMO, continued to drop in price in Tuesday’s trade with average yield rising 95 basis points to close at 6.4% as against Monday’s 5.5%, according to a note by FSDH securities. Yields on OMO bills averaged 2% last week Friday.

Rates on the securities maturing Tuesday next week rose the highest by 201 basis points. In the sovereign bond segment, eight-year debt due Feb. 2028 rose the most, adding 164 basis points on Tuesday. The S&P FMDQ local sovereign-bond index dropped as much as 2.1% Monday, extending year-to-date fall to 12.5%.

“Investors repriced yields higher on the back of expectations for a higher rate regime,” Lagos-based Chapel Hill Denham Securities Ltd. said in a note to clients late Monday. “We expect further repricing of OMO yields to be sustained in subsequent sessions this week.”

The sell-off has been sparked after the central bank of Nigeria almost doubled returns on the OMO securities it sold in its auction last week. The regulator’s offering of higher yields in the auction is seen as a bid to lure foreign investors back to the country after a shortage of dollars and weakening naira has kept them away for almost a year.

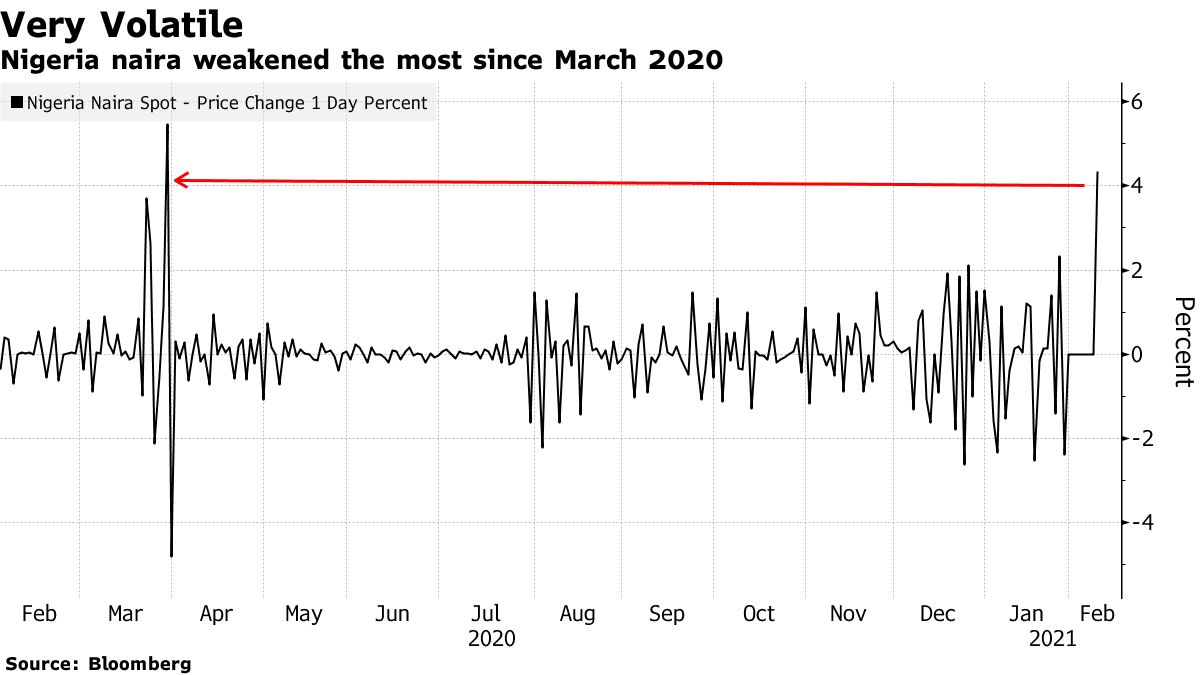

The local unit has come under significant pressure with the spot rate weakening by 5.3% to 401 to the dollar on the spot market, the lowest since March 30 last year, before paring losses to 397.50 at close.

The naira has already been devalued twice after oil prices plunged last year, though the recent rebound in the commodity’s price is expected to boost foreign-exchange reserves in Africa’s largest crude producer and reduce further devaluation pressure.

Investors will get better clarity on rates direction from an OMO auction scheduled this week, Adetoun Dosunmu, head of fixed-income, currencies and treasury at FBNQuest said.

If the central bank reduces the rate from what it offered last week, “then we will know the previous auction was just a fluke,” she said by phone from Lagos.

A total of 214 billion naira OMO maturities is expected on Tuesday, Lagos’ Rand Merchant Bank said in a note.

A lack of clarity on the next line of action by the banking regulator has increased market uncertainty, said Samir Gadio, the London-based head of Africa strategy at Standard Chartered Bank.