How Nigeria’s Flex Finance helps small businesses better manage their finances

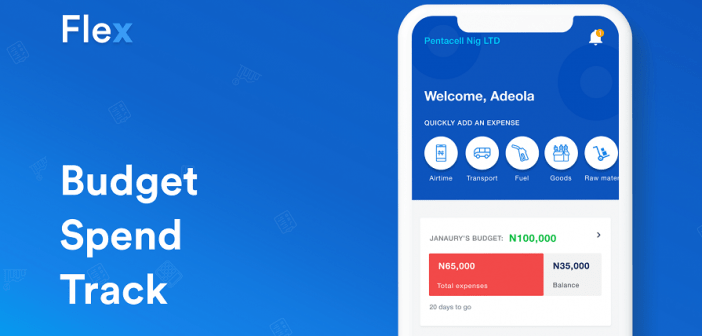

Nigerian fintech startup Flex Finance is building out a mobile ecosystem that helps SMEs and solo entrepreneurs better manage and track their daily business expenses and finances.

Essentially, Flex is allowing businesses to digitise their daily operations via a simple, accessible mobile platform. Equipped with an intuitive user interface, operating the app requires little-to-no financial knowledge.

The goal of the company, which was formed in September 2019, is to help micro, small, and medium enterprises (MSMEs) become smarter and more profitable.

Flex was born out of the Company Builder initiative launched by Accion Venture Lab, which is aimed at building inclusive fintech startups from scratch to reach the millions of financially underserved Nigerians. The second programme concluded late last year, and Flex was the overall winner, bagging US$100,000 in funding and technical support from Accion Venture Lab.

“During the programme we talked to over 50 business owners, and from there we discovered that businesses had problems keeping track of their expenses and they admitted it was greatly affecting their business negatively,” Yemi Olulana, chief executive officer (CEO) of Flex. told Disrupt Africa.

“Their process was largely manual and paper-based, resulting in inefficiency and wastage. And with that Flex was born.”

The market the startup addresses is large. SMEs account for over 65 per cent of economic activity in Nigeria, but need help, with more than half of such businesses failing within three years.

“Our findings revealed poor financial management as the root cause, leading to their exclusion from essential financial services like loans and insurance, and ultimately their sudden death,” said Olulana.

Flex aims to prevent such deaths, and after taking in a further US$200,000 in funding in the first half of this year is already being used by over 1,500 MSMEs. This is only in Nigeria for now, but the startup does have plans to expand.

“Our consideration lies within the top ten African economies, but it is still early-stage so nothing is set in stone,” said Olulana.

Flex, which also plans to add to its product offering over the next few months, charges customers a monthly subscription to use its platform, and has seen strong uptake even in spite of the COVID-19 pandemic.

“Our mobile app was released during COVID-19, with a lot of SMEs experiencing the strain of the lockdown and enforced social distancing. However, we were able to onboard over 1000 businesses in our first month,” Olulana said.