Uganda joins African exchanges link

The Uganda Securities Exchange (USE) has become the tenth African securities exchange to join the African Exchanges Linkage Project (AELP). The linkage platform enables stockbrokers on participating exchanges to send orders on behalf of their clients to stockbrokers on other exchanges, who will buy and sell shares on those exchanges.

Ten 10 stock exchanges representing 17 countries are participating, including Uganda. The African share-trading link aims to boost the potential for cross-border investment, collaboration and capacity building across Africa. The aim is better liquidity on the capital markets, wider access to capital and more opportunities for investors.

The capital market infrastructure interconnectivity platform is a joint project between the African Securities Exchanges Association (ASEA) and the African Development Bank (AfDB). The link is funded by the Korea African Economic Cooperation Fund (KOAFEC) Trust Fund, managed by the AfDB. KOAFEC also supported Phase 1.

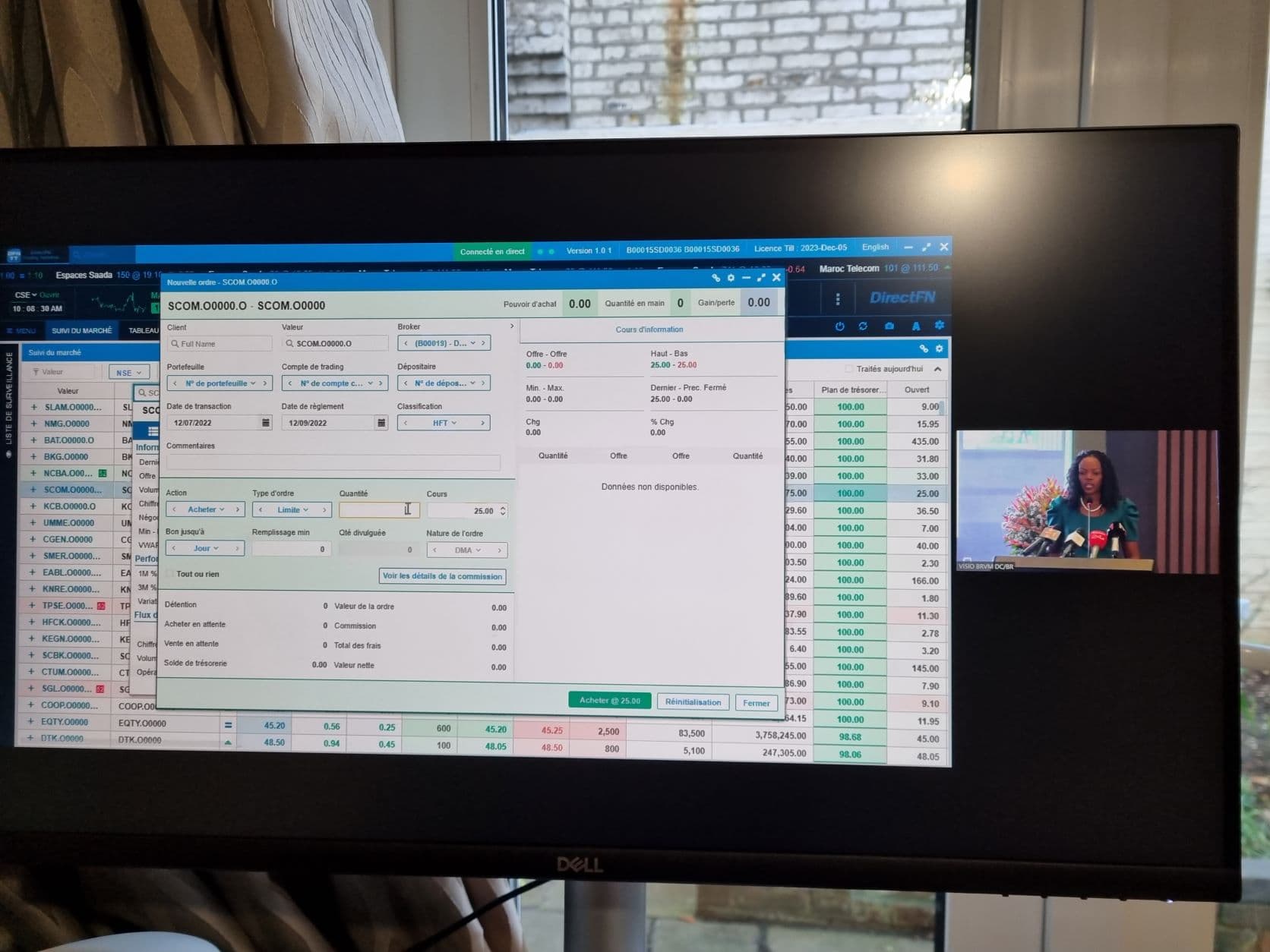

The technology platform is provided by DirectFN.

The first phase (2019-2021) covered the design and setting up of the project and the inclusion of seven leading African exchanges and 31 stockbrokers. Participating exchanges from Phase 1 are Bourse de Casablanca, Bourse Régionale des Valeurs Mobilières (BRVM), The Egyptian Exchange, Johannesburg Stock Exchange, Nairobi Securities Exchange, the Nigerian Exchange and Stock Exchange of Mauritius. BRVM is the regional exchange grouping Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo.

Phase 2 stock exchanges to date are Botswana, Ghana and Uganda. The aim is to reach 15 exchanges.

An ASEA press release says the stock exchange linkage now includes “potentially over 40 stockbrokers” and mentions Ugandan stockbrokers are Crested Stocks and Securities Limited (Crested Capital) and SBG Securities Uganda Limited.

The AELP first went live in November 2022 and was launched on 7 December with a demonstration of live trading. On 28 June 2023, the AfDB and ASEA signed a second grant agreement, this time for $600,000, to facilitate including more exchanges.

The Uganda Securities Exchange was established in June 1997, it automated its Securities Central Depository (SCD) in 2010 and it restructured and demutualized in 2018. The USE is also a participant in the Capital Markets Integration (CMI) project of the East African Community.

Pierre Celestin Rwabukumba, president of ASEA and CEO of Rwanda Stock Exchange, said: “Uganda coming on board with other ASEA member exchanges will enhance collaboration and economic growth within participating exchanges thus enhancing further the wider Africa Continental Free Trade Area (ACFTA) efforts.”